Purchasing land can be a fulfilling endeavor, whether you plan to build your dream home, start a business, or invest for the future. However, the upfront cost of buying a property can be a significant hurdle for many aspiring landowners. Fortunately, there are various options available to acquire a property without having to pay the full purchase price upfront in cash.

There are various options we can explore to purchase land in Kenya:

Mortgage loans

One of the most common methods for buying land without cash is securing a mortgage loan. Many banks and lending institutions offer land loans or vacant land mortgages specifically designed for plot purchases. These loans typically come with competitive interest rates and varying terms. To secure a mortgage, you will need to meet certain credit and financial requirements, including a down payment, proof of income, and a good credit score. Many banks in Kenya offer mortgages to individuals at different rates of 7.1 to 15 percent. The property that you intend to buy acts as collateral for the loan. Therefore, make sure you choose a bank that fits your needs.

Sacco

Buying plots with Sacco financing is another option. The amount of loan you qualify for is usually three to four times the size of your savings at a Sacco. One advantage of Sacco loans over bank loans is that they are easier to access as long as you are a member. A member of the Sacco can become your guarantor. They are cheaper and pay higher interest rates on member savings. They also pay dividends to their members.

Lease with the option to buy

In some cases, you might find landowners willing to lease the plot with an option to buy in the future. This allows you to use and develop the land while postponing the full purchase until a later date when you have the necessary funds. Lease payments over time can be used as principal funds to make a purchase. Once the plot is paid off, the seller transfers the title deed to you. It’s essential to outline all terms and conditions clearly in the contract, including the interest rate, payment schedule, and consequences of default.

Seller/ Owner Financing

Owner financing is an attractive option where you negotiate directly with the landowner to arrange a financing agreement. In this scenario, you make regular payments to the seller over a predetermined period until the land is fully paid off, which may include interest. This can be an excellent choice for those who may not qualify for traditional bank loans or want more flexible terms.

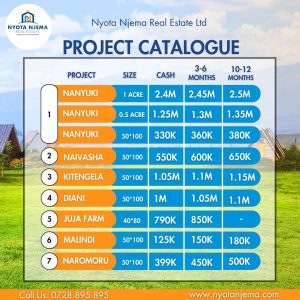

At Nyota Real Estate, we have flexible payment plans for all our projects, with a deposit as low as Kshs. 50,000 and installments of up to 10 months. With this, we have sorted out the need for loans or institutional financing. You can visit our offices to get the perfect deal for you.

Conclusion

Land buying in Kenya is possible for anyone who wants to build a permanent residence or invest. The key to a successful land acquisition is to carefully assess your financial situation, explore the financing alternatives available to you, and negotiate favorable terms that align with your goals.

It’s essential to conduct thorough research on the land, perform due diligence, and seek legal and financial advice to protect your interests. With careful planning and the right financing option, you can turn your property ownership dreams into a reality, even if you don’t have the cash on hand. Remember that each option has its advantages and disadvantages, so choose the one that best suits your needs and financial situation.

For more information, call/chat with us today!